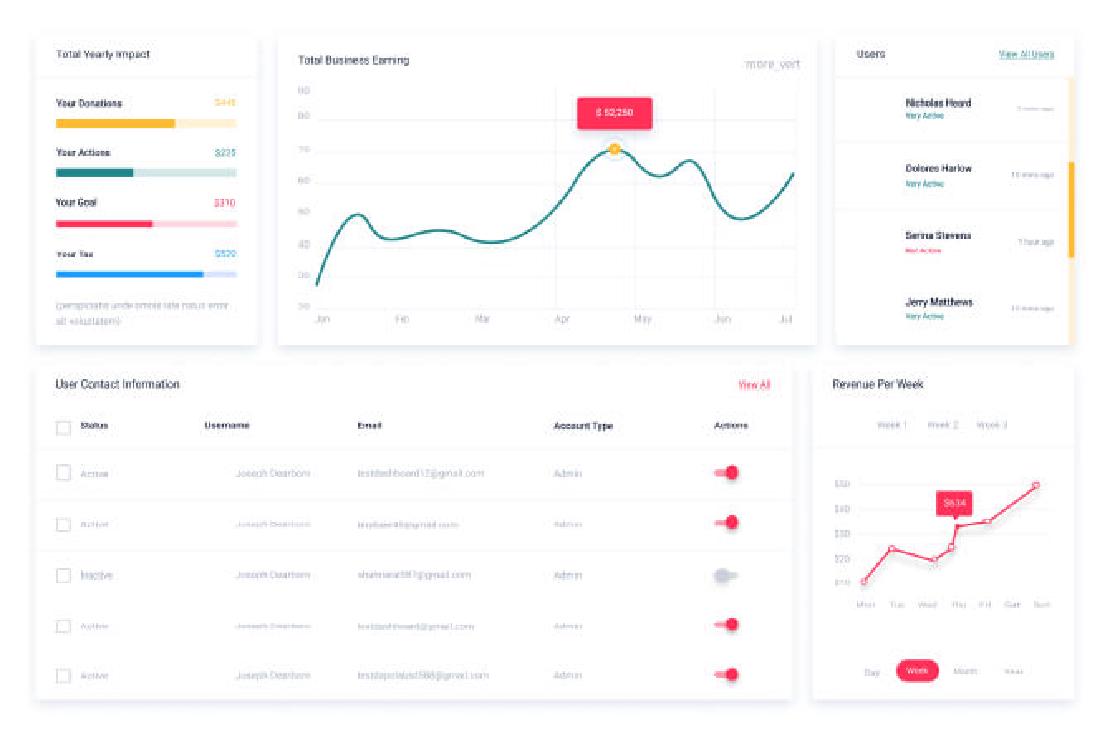

How it Works

Our easy to use interface helps you to automate your business processes.

Seamless Document Ingestion

DocuSense can seamlessly ingest documents from Dropbox, Gmail, Google Drive to help automate your workflows

Extract data from Documents

Use our pre-trained AI models to extract data from your documents e.g, invoices, receipts, etc. Or, you can train your own AI model by using your own documents.

Validate Extracted Data

You can create validation rules to validate extracted data and mark documents for manual review that doesn’t match the rules configured by you

Push data where it belongs

Use our native integrations with common tools like QBO, Xero, Sage Intacct and automatically push data where it belongs

Integrate the tools you already use

Integrate your existing tools with DocuSense and automate data collection, exports storage and bookkeeping.

Benefits

Less manual work

Freeing your team to focus on higher-value activities

Faster turnaround

Focus on your core product, and build on your competitive advantage quickly. We handle giving you a robust document extraction platform

Validate extracted data

Quickly validate data captured from the document and the AI learns and improves as your usage multiplies.

Highly accurate

Train AI models specific to your documents to achieve accuracy close to 100%